This post is about one of the many issues facing anyone trying to do marketing attribution – how do you measure the impact of offline activity on online success? If you’re selling online, but you’re carrying out offline activity (TV ads, magazines, direct mail, events, arguably word-of-mouth) then you don’t get this sort of insight “out-of-the-box” with Google Analytics – well, not yet at least!

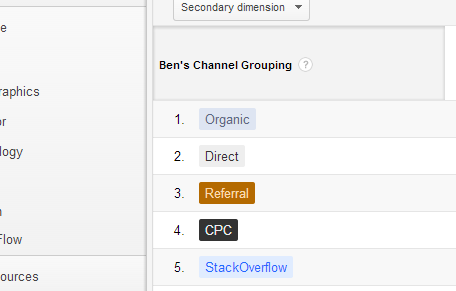

Avinash Kaushik (@avinash) has written a great post here, describing the problem in a simple way. Essentially, how do you figure out where all of that Direct and, in our case at least, most of the Organic traffic is coming from? I’m not showing figures, but the snapshot below shows the five most important channels for part of Red Gate’s business:

NB: This is based on a channel grouping and attribution model that I described in a previous post (I’ll write another post later about the set up of this model for us). It’s not “Last click” attribution by a long shot (and so doesn’t suffer many of the problems of that model), but does still present an issue of how to get some insight in to where traffic is really coming from.

For us, the vast majority of “Organic” is people just typing in the names of our products or company (i.e. it’s not SEO as such, it’s just people who can’t be bothered to type in “www.red-gate.com”). And Direct is the black box that it is for everyone else.

Having lots of this Direct and Organic traffic is great of course! Everyone knows us already – maybe we should pack up, go home and leave the traffic to roll in!?! But, for me this isn’t really enough. Knowing that there are stacks of people out there just typing in our product names, without having any idea what we’ve done to influence that is tough. Particularly as we spend a lot of money on events and other offline activities – we need to know the impact of these.

Separately, I’m about to start helping with a piece of work for a large direct mail provider to help them prove the importance of direct (postal) mail in an online world – they need to be able to prove this impact (it’s not just enough to say “Of course it works – it always has!”, when everyone else is using Google Analytics to prove the impact of online activities). They need to link direct mail to Google Analytics – Universal Analytics really – so that customers can show the way that direct mail drives online events and eventually revenue.

Anyway, here are the things we’ve done historically to try and address this (most of which are as Avinash has suggested) and then want we’re going to try in the future.

What We’ve Already Tried

- Doing it by hand. As described in an early post of mine, it’s possible to go through, by hand, and track all of the revenue generated by a specific offline activity. E.g. “We did that event in Colorado, let’s manually track everything that happened with the people we spoke to”. This does have the advantage that, data problems aside, you should be producing a pretty accurate picture of the ROI on a particular activity. The downside is that it’s very manual. And worse – it only tracks activity for point-in-time activities. What about the general background activity going on – word of mouth, ongoing ads/campaigns and so on?

- Redirect URLs on offline material. E.g. we go to a certain event, and the URL plastered over everything is something like “www.red-gate.com/agile2013event” or similar. This then redirects to a URL with UTM codes so that we can use GA to see the impact. Again, this works well for specific events, just not great for general background activity.

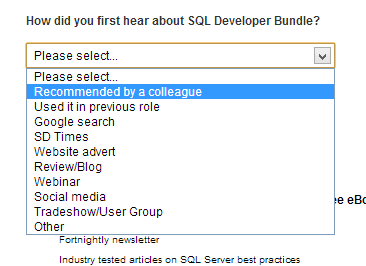

- Ask people on the website! Again, another of Avinash’s suggestions, but we have questions on our download forms, asking people where they heard about the product:

This has the significant advantage that it includes things like “Recommend by colleague” as well as other offline activities such as tradeshows. Also, by mixing online and offline answers in one question, this gives you some measure of relative importance of different activities (even if absolute numbers don’t mean much). NB: A number of people leave this as “Please select..” (we don’t force people to answer), so it’s flawed, but the info is still very useful. NB: Around half of people in total answer either “Recommended by colleague” or “Used in previous role” – get a great product and half of your marketing job is done for you..

All of the above have provided interesting bits of information, but none have provided anything like the data we really need to accurately compare online with offline marketing and to treat all sources equally. As I’ve said before, I suspect this is a Sisyphean task, but that shouldn’t stop us trying.

What We’re Going to Try in the Future

There are two approaches we’re going to try next – one based on Google Universal, the other with HubSpot.

- Google Universal. I’m really excited about the possibilities of Google Universal Analytics. It’s still only in public beta, but the most interesting parts are to do with allowing companies to collect data about offline activity then load this up in to GA like any other channel. Previously it has been possible to pull in data about, say, an event and track that manually (my option 1 above), but without it being integrated in to GA, it’s hard to weigh different activities against each other accurately. We’re looking at using this for a number of different types of offline activity in the coming months and will report on progress! It’s also the key method I’ll be suggesting for the direct mail initiative – how great would it be to be able to show the impact of direct mail accurately alongside SEO, PPC, videos, content marketing and so on?

- HubSpot – an alternative, but very related approach is marketing automation. I’ve written about this before, in relation to Eloqua’s product, but marketing automation tools allow you to automatically start tying various activities (offline and online) to the good leads that you generate. The dream (which I know will take work to achieve) is that when we’re looking at a great lead that’s come in to the system, we’ll be able to see what that person has seen and done beforehand, for example:

- Attended event where we were exhibiting,

- Read some articles on our sister publishing sites,

- Searched for some products,

- Found our site, read the product homepages, and downloaded the whitepaper,

- Came back a month later and downloaded the product,

- Tried the product and used the key features,

- Came back to our site and clicked on the pricing page.

…at which point we’d probably give him or her a call! At first glance it may seem that only one of these is an offline activity (the event), but actually things like “Trying out the product and using key features” are also offline in the sense that they’re not immediately trackable in web activity. Products like HubSpot provide APIs that allow you to feed in other data that isn’t immediately available so that you get a fuller picture of what the lead has been up to.

We’ll see how both of these methods work out though both do rely on the same thing – some mechanism for indicating offline activity online, either in GA or HubSpot. However one great thing about HubSpot in particular is that we already track a lot of offline activity in our CRM (for example, adding references on tags for people who we meet at conferences), and this could easily be pulled in as part of the history for a lead. I.e. if we’ve recorded in our CRM that Joe Bloggs went to our conference a year ago and now, a year later, is reading our whitepapers, then this will automatically get shown and we can, in theory, start automatically showing the value of this offline activity.